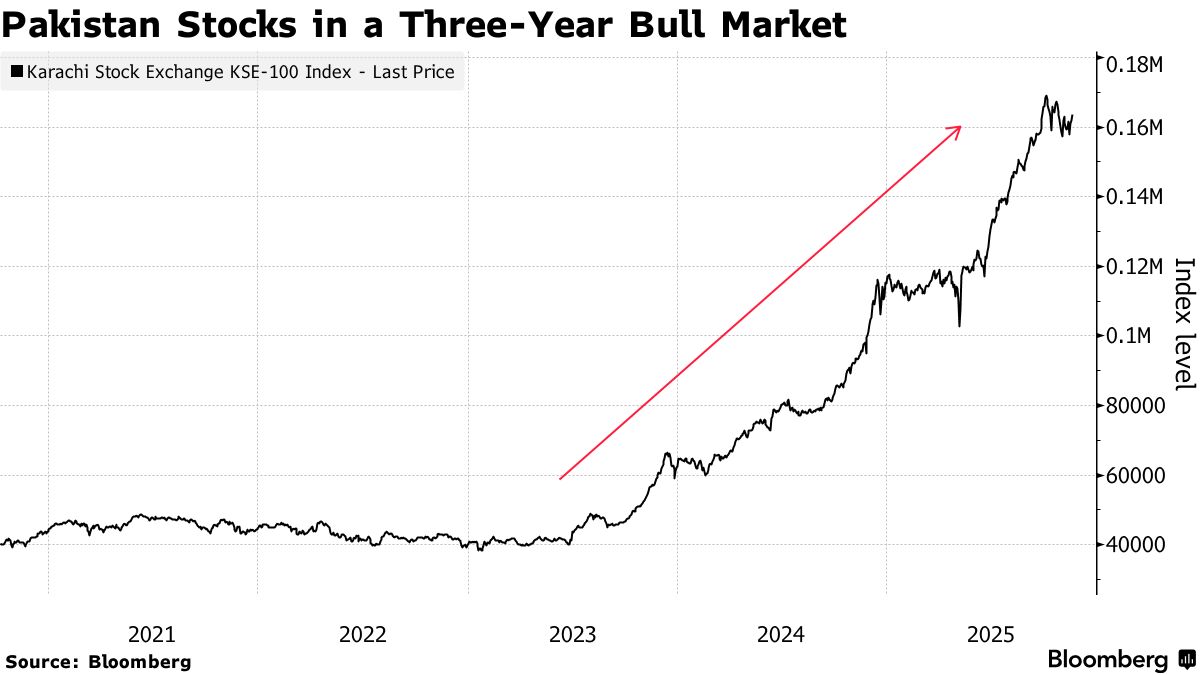

Complete Guide to Pakistan Stock Exchange (PSX) for Beginners

Why PSX Matters for Every Pakistani Investor

Thinking about investing but confused about where to start? You’re not alone. For many Pakistanis, the Pakistan Stock Exchange (PSX) sounds intimidating—charts, indices, brokers, and financial jargon everywhere. But here’s the truth: PSX is one of the most accessible long-term wealth-building tools in Pakistan if you understand the basics.

I’ve personally seen beginners start with small investments, learn patiently, and grow their confidence over time. IMO, PSX isn’t about “quick money”; it’s about discipline, learning, and consistency. This Pakistan Stock Exchange guide is written specifically for PSX beginners who want clarity, not hype.

So, let’s break it all down—step by step, in plain English.

What is PSX?

The Pakistan Stock Exchange is Pakistan’s only stock exchange, formed in 2016 after the merger of Karachi, Lahore, and Islamabad stock exchanges. It operates under strict regulations and plays a central role in the country’s economy.

What Does PSX Actually Do?

PSX provides a regulated platform where:

- Companies raise capital by issuing shares

- Investors buy and sell shares

- Market prices reflect company performance and investor sentiment

In simple terms, when you buy a share, you own a small part of that company.

Who Regulates PSX?

PSX is regulated by the Securities and Exchange Commission of Pakistan (SECP), ensuring transparency and investor protection.

You can verify regulations directly from SECP’s official site: https://www.secp.gov.pk

FYI, PSX is also recognized by global financial bodies and has attracted foreign investors over the years.

READ: Maulana Tariq Jameel Biography

How to Open a Trading Account

Opening a trading account is your first real step toward investing. Thankfully, it’s easier than most people think.

Step-by-Step Process

1. Choose a Licensed Broker

Select a PSX-registered brokerage firm. You can verify licensed brokers on PSX’s official website:

https://www.psx.com.pk

2. Submit Required Documents

You’ll usually need:

- CNIC copy

- Bank account details

- Proof of income (sometimes)

- Online or physical account opening form

3. Digital Account Opening

Most brokers now offer online account opening, making it beginner-friendly and fast.

4. Trading & CDC Account

Your broker will open:

- A Trading Account (for buying/selling)

- A CDC Account (to hold shares securely)

Pro Tip: Start with a small amount. You’re learning, not gambling.

Types of Shares and Indices in PSX

Understanding what you’re buying is critical. Let’s simplify it.

Types of Shares in PSX

Ordinary (Common) Shares

- Voting rights

- Dividend eligibility

- Most commonly traded

Preference Shares

- Fixed dividends

- Limited or no voting rights

- Less common for beginners

Key PSX Indices

Indices show the overall market direction.

- KSE-100 Index – Tracks the top 100 companies (most popular)

- KSE-30 Index – Free-float market performance

- All-Share Index – Covers all listed companies

You can track indices live on PSX’s official site or financial portals like Wikipedia:

https://en.wikipedia.org/wiki/Pakistan_Stock_Exchange

Investment Strategies for Beginners

If you’re new, strategy matters more than speed.

1. Long-Term Investing (Best for Beginners)

Buy strong companies and hold them for years.

- Focus on fundamentals

- Ignore daily price noise

- Reinvest dividends

This strategy has historically rewarded patient investors in PSX.

2. Dividend Investing

Some companies pay regular cash dividends.

- Ideal for passive income seekers

- Banks, energy, and cement sectors often offer dividends

3. Rupee-Cost Averaging

Invest a fixed amount monthly, regardless of market conditions.

- Reduces risk

- Builds discipline

- Perfect for salaried individuals

4. What Beginners Should Avoid

- Day trading without knowledge

- WhatsApp “tips”

- Over-leveraging or borrowing to invest

Remember: Slow and steady wins here.

Risks of Stock Market Investment

Let’s be real—PSX isn’t risk-free.

Major Risks You Should Know

Market Risk

Prices fluctuate due to:

- Politics

- Interest rates

- Economic conditions

Company-Specific Risk

Poor management or weak earnings can hurt a stock.

Emotional Risk

Fear and greed cause bad decisions. Most beginners lose money not due to PSX, but due to emotions.

That’s why learning first is non-negotiable.

Tips for Safe Investing in Pakistan

Here’s what experienced investors usually follow:

- Diversify across sectors

- Invest only surplus money

- Follow PSX and SECP announcements

- Read annual reports (even summaries help)

- Avoid hype-driven decisions

Bold takeaway: Education is your best risk management tool.

Real-World Example: A Beginner Case Study

A friend of mine started investing in PSX with PKR 50,000. Instead of chasing fast gains, he:

- Bought blue-chip stocks

- Held for 4+ years

- Reinvested dividends

Result? Moderate but consistent growth—and more importantly, confidence. That’s the real win.

FAQs: Pakistan Stock Exchange for Beginners

1. Is PSX halal?

Most scholars consider equity investing halal if companies avoid haram activities. Always check company business models.

2. How much money do I need to start?

You can start with PKR 5,000–10,000, depending on the broker.

3. Can students invest in PSX?

Yes, if you’re 18+ with a valid CNIC and bank account.

4. Is PSX safe for beginners?

PSX is regulated, but knowledge determines safety.

5. How long should I hold shares?

For beginners, long-term (3–5 years) is usually safer than short-term trading.

Final Thoughts: Should You Invest in PSX?

If you’re looking to beat inflation, build long-term wealth, and learn how markets work—PSX is worth exploring. This Pakistan Stock Exchange guide is just the beginning. Start small, stay curious, and keep learning.

Because in investing, the real power isn’t money—it’s patience and knowledge.